Get Email Updates

Get an email the instant your dream home hits the market with your MyLogin account

Updated June 24, 2025 5:28AM EST

View exclusive Market Reports & Stats on your South Florida Community.

Get your Free Market ReportDetermine your home's estimated value based on ecent homes sales in your area.

The largest and most complete private directly of commercial listings not on the MLS. Contact us directly with your specific needs to see if we have a match.

3 JAN

.Blog | Buying | Jeff's Journal | Market Updates & Statistics | Must Read | News | Selling

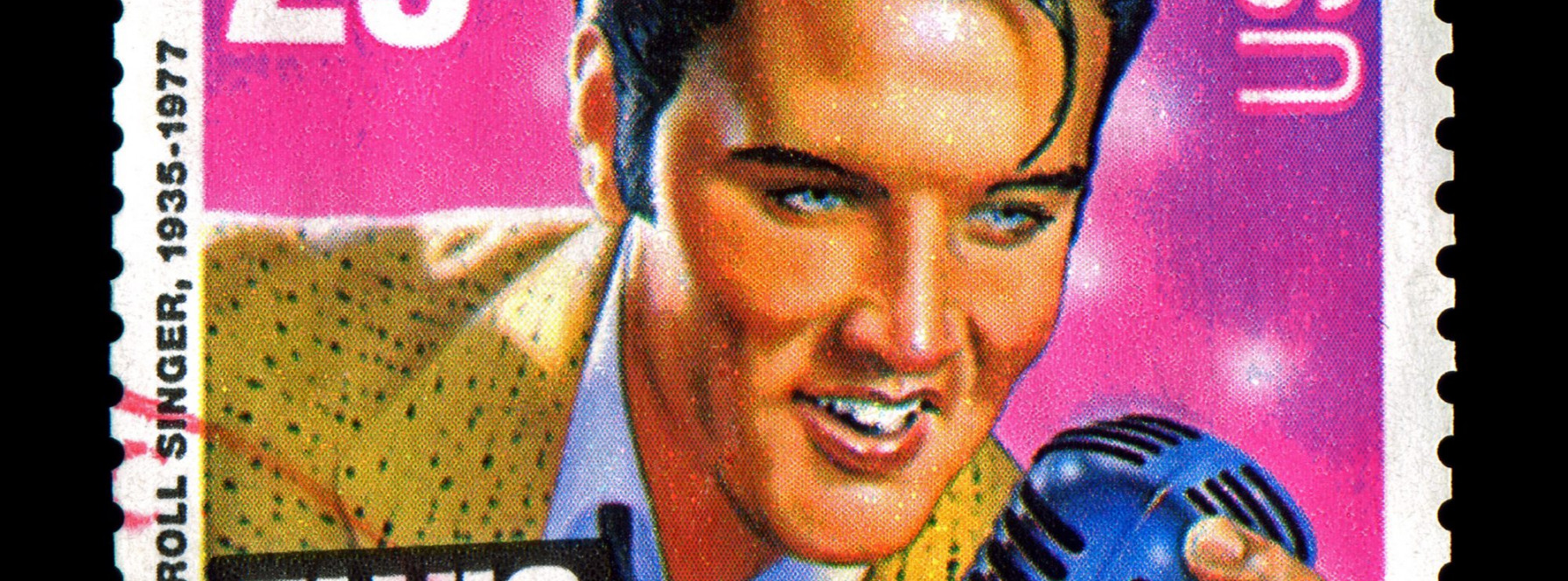

People all over the world say Americans are too trivial because of our obsession with social media and gossip. That we are not serious people about topics such as the environment and other pertinent societal issues. While this might be true, we have always been kinda nuts. As proof just go back to 1977 and Elvis.

Elvis Presley dominated the news cycle for over a decade after his death. Chatter tabloids all went crazy with rumors that Elvis was indeed alive. Elvis sightings were constant. Elvis impersonators (today called tribute brands) were prevalent. The zenith occurred when a national debate broke out about the Elvis stamp. The US Postal Service announced they would come up with a stamp honoring Elvis. The nation was “caught in a trap” (Elvis’ last #1 song) in whether to use the svelte 1950’s Elvis or the plump 1970’s Elvis.

The real estate market has also been caught in a trap that we can’t seem to get out of going into 2025. This brings me to the crystal ball for 2025….

The crystal ball for 2025 is somewhat predictable going in, but there is some fogginess. All things being equal, the market right now is very clear. If interest rates are close to 6%, Buyers are purchasing. Go past 6.75% and markets slow down. That has been the trap as interest rates go back and forth. I will also say this up front about the next 5-10 years. 5 years from now, I think this will just be an odd 3-4 (we are already 2 ¾ years in this cycle) year cycle on a graph where activity slowed, inventory spiked, and prices stabilized. At some point, the market will take off again because the ingredients of great weather, no state income tax, proximity to airports, lifestyle, culture, activities, and no land left to build upon in prime areas with population growth are all facts of life. This will be looked upon as the best opportunity to purchase and I have no question that we are much closer to the end of the cycle. It’s always impossible to predict exactly when the end of a cycle occurs.

Activity

Activity in 2025 in the United States is projected on average to increase 5% over 2024 according to several nationwide conferences I attended late last year and talking with economists and other brokerages throughout the county. The caveat is that individual marketplaces will vary as they always do. Regions with heavier inventory and strong demand will see a higher uptick in activity. Our market in South Florida is an example of this and I’m expecting a 7-10% jump in activity compared to 2024. Areas with low inventory (the northeast) and soft demand should see less than a 5% jump in activity. Keep in mind that 2024 saw its slowest growth since 2024 so even a 5 or 10% bump is still low, historically. Right now, we are seeing more activity from pent up demand of people held off due to uncertainty of the election. Those in the wealthier category are definitely purchasing more as they know taxes and capital gains will be at lower levels with the election over. While sales were down in November compared to the previous November, pendings for future months are up 4% (a major turnaround) so expect strong sales announcements for January and February. It may also be a leading indicator of what is to come for the rest of 2025.

The Condo Market

Regional laws and regulations will influence sales as well. The condo market in South Florida has seen its inventory jettison upward to over 8 months of supply and nearly a 100% jump from last year at this time. This is due to regulations resulting from the tragic Surfside building collapse. Laws were put in place to safeguard the public against another incident and required every three story or higher building that is twenty-five years of age and within three miles of the coastline or thirty years of age and more than three miles from the coastline to get an engineer study by the end of 2024. Not only do those items found to be deficient need to be replaced but an examination of books ensures that proper reserves are in place for the future. Basically, the condo commando has been tamed by the state eliminating boards that ignore problems and don’t plan for future expenditures. It has forced condo associations to special assess or raise the homeowner’s association dues. In addition, insurance has gone up since Surfside with higher values of condos across the board. All of this resulted in the increase of inventory. Some condo owners have rented their unit out, but there is future shadow inventory that will come back on the market at the end of the seasonal renting season in April or May. “Must Sellers” will be the ones to set the market as they are outweighing “Must Buyers” at the moment. However, with cost certainty it won’t be long until the tide turns in the condo market. Every condo is different and condos that had little special assessments or newer ones won’t have the same degree of inventory available. Don’t expect the shoe to fit every size foot. While this should take a year or two for inventory to lessen, there isn’t land to build new condos on in prime areas by the water. With the uncertainty of assessments over, the consumer can buy with confidence. It should also be much easier to get a mortgage on a condo because of this cost certainty and confidence of future costs. In a few years I think the condo market which has suffered net price drops will explode and prices today will be bargains. I can’t repeat enough how the uncertainty of what the inspections would reveal over the past 2 years has held back on purchasing. I called it at the time, “Condo Chaos” and said it would turn into “Condo Calm”. We are entering the calm phase right now.

Policies

What becomes foggy is how the new administration will affect the markets. Deportations and tariffs will all have an impact on inflation and the markets. Those could impact interest rates. Steve Mnuchin, the former Treasury Secretary mentioned that the Treasury could influence mortgage rates by putting a cap on the 10 year yield and subvert the Fed. If unemployment goes up (Fed goal) then that also could bring the 10-year yield down and thus lower interest rates. The spread of the yield is lower now, so if the economy cools, expect rates to drop. Unknown policies like this will end up being things to watch as the crystal ball will become clearer.

PBC Most Important County in the USA

Another wildcard is how much growth the area sees because of Mar-a-Lago being the center of political activity over the next four years. Elon Musk camping out in the Bristol, Ken Griffin moving his Hedge Fund operation to South Florida, and Steve Ross stating that all of Palm Beach County will become the most important county in the country. “This whole county in the future will become what Silicon Valley is today”. If you want to lobby your business and have government influence, you must be in South Florida today. People assumed in 2016 that Washington DC would be the place to be as it always has been. This time around, people know that Palm Beach is important from the get-go. That means much higher demand for business, government officials, lobbyists, lawyers, and anyone looking to buy primary and secondary homes located here. It could result in an explosion of demand. On the business side, lots of financial companies have already made the move to West Palm Beach (Wall Street South) and Miami. Once the base is established, it’s much easier for growth to snowball. This could happen quickly.

Summary

I’ll go back to what I said earlier. Inflation hit 9.1% in April of 2022. The Fed had to then raise interest rates to stifle inflation. For the most part that has worked but the battle to get to 2% isn’t an easy one. Meanwhile as we near the three-year mark on the slowest activity in the real estate market, the market is much healthier than it was 3 years ago. We now have a decent amount of inventory in South Florida. Even if the economy took a hit, inventory won’t get super high. That is because only qualified people get loans these days and the vast majority are strong. There has been an uptick in credit card debt but most of that is with people who are not homeowners. We will not see foreclosures or short sales on a scale.

The consumer has now accepted that the days of 3-4% interest rates are a thing of the past. As the percentage of the population pays off their loans or has moved on from their 3-4% rate, the desire to move on with life is getting stronger. We have lots of pent up demand. 6% is the magic number and we know when 6% interest rates occur, the consumer is buying. 6% interest rates historically are pretty good. Even if you get an interest rate of 6.75% or 7%, you can always renegotiate the rates. When the market takes off, you can’t renegotiate the price you paid for the house. We all put a few pounds on from the holidays like Elvis – but if you find your dream home, don’t be afraid to put on your Blue Suede Shoes. After all, life is about living and there is nothing like the feeling when you can’t help falling in love with a new home. It’s much better then living in a heartbreak hotel.

Jeff Lichtenstein, originally from Chicago, got his start in the home furnishings textile business where he traveled over 35 weeks a year selling fabrics. After the family business was sold, Jeff moved to Florida and became a real estate agent. Today he is the owner and broker of Echo Fine Properties, a luxury residential brokerage voted best brokerage of the year. Jeff manages a non-traditional model of real estate that mimics a traditional business model. Echo has 80 agents, an average of one million dollars per transaction and over 500 million in annual sales. Between traveling for work and annual family trips to national parks with his wife and 2 now adult children, Jeff has visited 49 states. He is also one of the few Chicago White Sox fans you’ll ever meet. Some publications he has been quoted in.

Author of business & leadership book How Making a Sandwich Can Change Your World – The Amazing Success of the PB&J Strategy – Available to Buy Now!

Feel free to ask him a question directly at jeff@EchoFineProperties.com including a complementary valuation of your home.

6 Beds | 6 Baths

Contact Craig at 561.246.1789

Offered at $2,895,000

More Info

5 Beds | 7 Baths

Contact Craig at 561.246.1789

Offered at $1,430,900

More Info

4 Beds | 4 Baths

Contact Craig at 561.246.1789

Offered at $1,247,900

More Info

3 Beds | 2 Baths

Contact Daniel at 561.371.0904

Offered at $899,890

More Info

3 Beds | 2/1 Baths

Contact Charles at 561.319.3742

Offered at $645,000

More Info

Echo Fine Properties, winner of Best Brokerage of the Palm Beaches in 2020, 2021 and 2022, is located in Palm Beach Gardens, Florida. We are a family-owned local brokerage that prides itself on having the finest full time luxury real estate agents who know the area backward and forward. Each agent is hand selected to join us for their knowledge of the area including golf club communities, gated communities, equestrian and ranch estates, condominiums, and waterfront and boating estates. Echo is unique in real estate in that our company pays for all marketing, advertising, and all support which is handled in-house. WE PAY, which lets the agent concentrate on our customers. Unlike other firms, agents never have to compromise the marketing budget. Our Home ECHOnomics Guarantee offers an unheard of 57-promises. This website consists of 5 separate MLS feeds, giving 100% accuracy ranging from Miami to Fort Lauderdale to Palm Beach to Martin County.

© 2020, © 2021 and © 2025 Echo Fine Properties, All Rights Reserved. Powered by Neutrino, Inc. Authored by Jeff Lichtenstein

Use of this website and information available from it is subject to our Privacy Policy and Terms & Conditions

or Create your MyHomes account today?

In only 30 seconds you will have full access to property, community info and SOLD data you can't get anywhere else.